Depreciation

The Depreciation is the reduction in the value of an asset due to usage, passage of time, environmental factors, wear and tear, obsolescence, depletion or inadequacy.

One way in which many people are exposed to the concept of depreciation is through car ownership. It is pretty well understood by most people that the value of a car typically decreases over time. What is true of cars is also true of infrastructure assets like; roads, buildings and drainage networks, even if it is less obvious and if as in the case or roads they are rarely sold.

International Infrastructure Management Manual

The International Infrastructure Management Manual defines depreciation as "The wearing out, consumption or other loss of value of an asset whether arising from use, passing of time,or obsolescence through technological and market changes. It is accounted for by the allocation of the cost (or revalued amount) of the asset less its residual value over its useful life."

AASB 116

AASB 116 defines depreciation as "the systematic allocation of the depreciable amount of an asset over its useful life."

Victorian Auditor-General's Office

The Victorian Auditor-General's Office defines 'depreciation' as; the systematic allocation of the value of an asset over its expected useful life, recorded as an expense.

Charging depreciation against an asset is a way of allocating money to the future replacement of that asset.

There are other ways this money could be allocated, but the calculation of how much assets have depreciated over a financial year is presumably mandated in on one or more regulations and/or accounting standards.

AASB 116 certainly states that "each part of an item of property, plant and equipment with a cost that is significant in relation to the total cost of the item shall be depreciated separately".

Reporting on Depreciation

Typically data in Council's asset register and/or asset management system is used to calculate depreciation. Annual depreciation and accumulated depreciation are recorded each year in a Council's annual financial statement. ???

Depreciation Methods

AASB 116 states that;

The depreciation method used shall reflect the pattern in which the asset’s future economic benefits are expected to be consumed by the entity.

The depreciation method applied to an asset shall be reviewed at least at the end of each annual reporting period and, if there has been a significant change in the expected pattern of consumption of the future economic benefits embodied in the asset, the method shall be changed to reflect the changed pattern. Such a change shall be accounted for as a change in an accounting estimate in accordance with AASB 108.

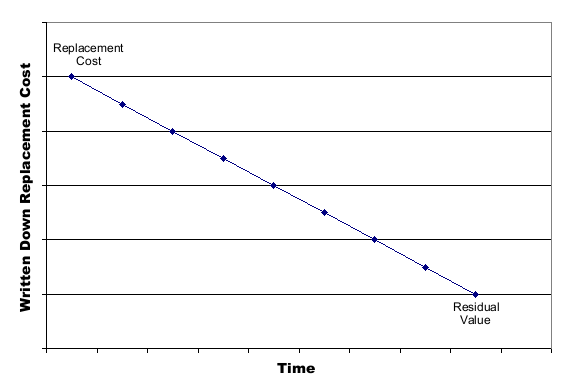

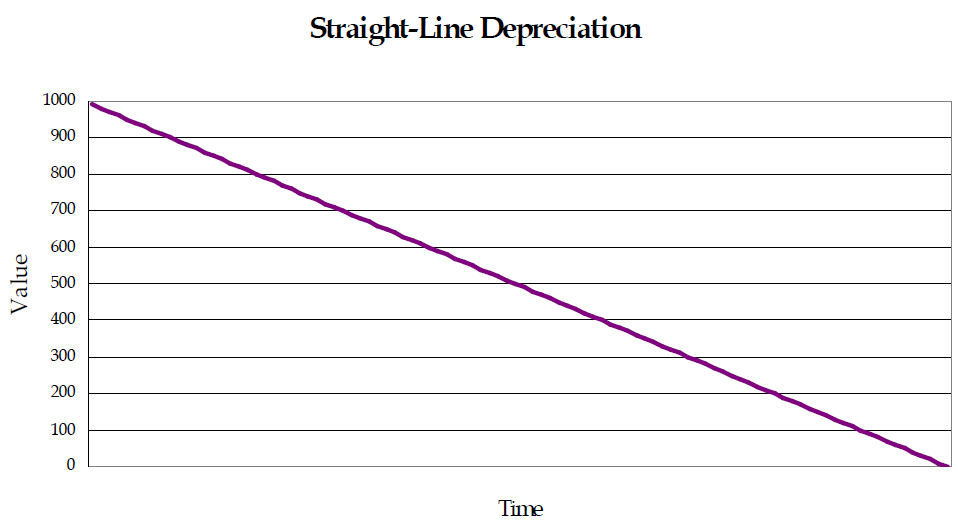

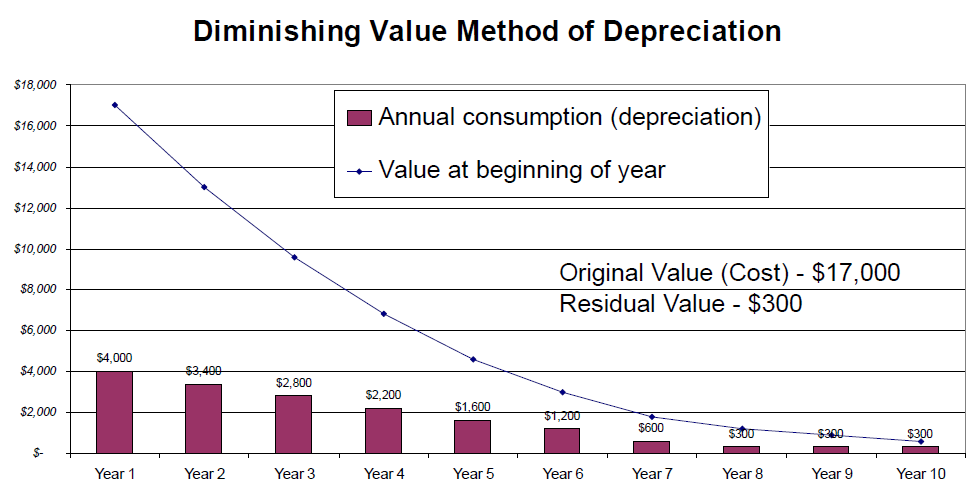

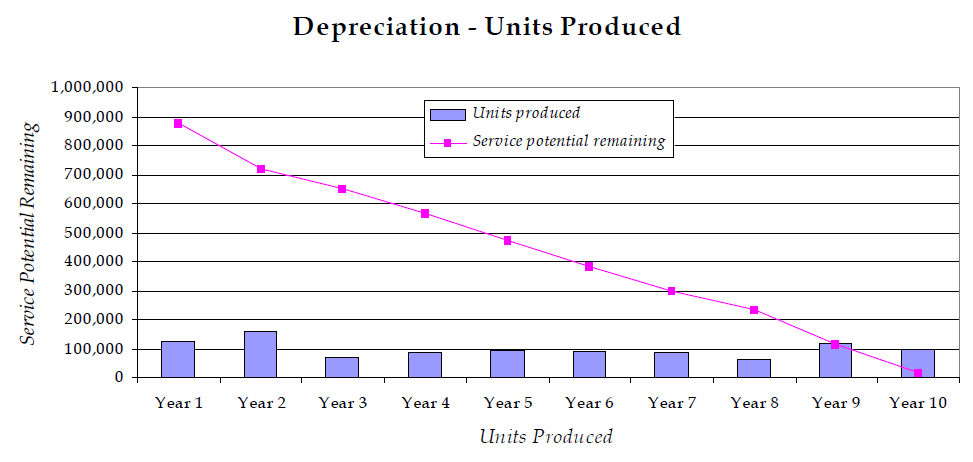

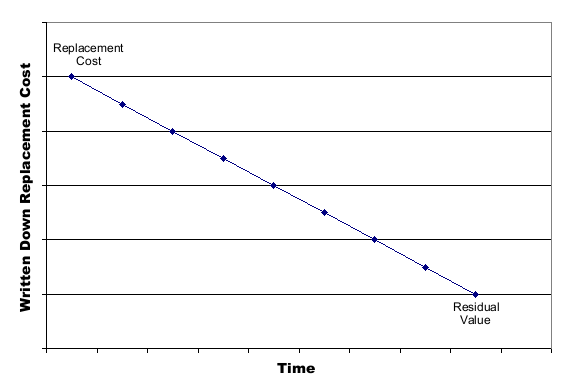

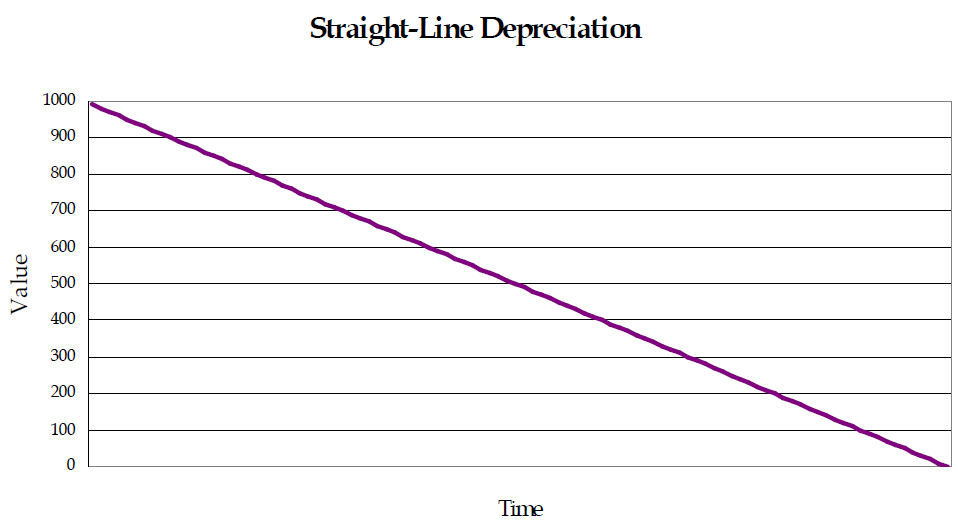

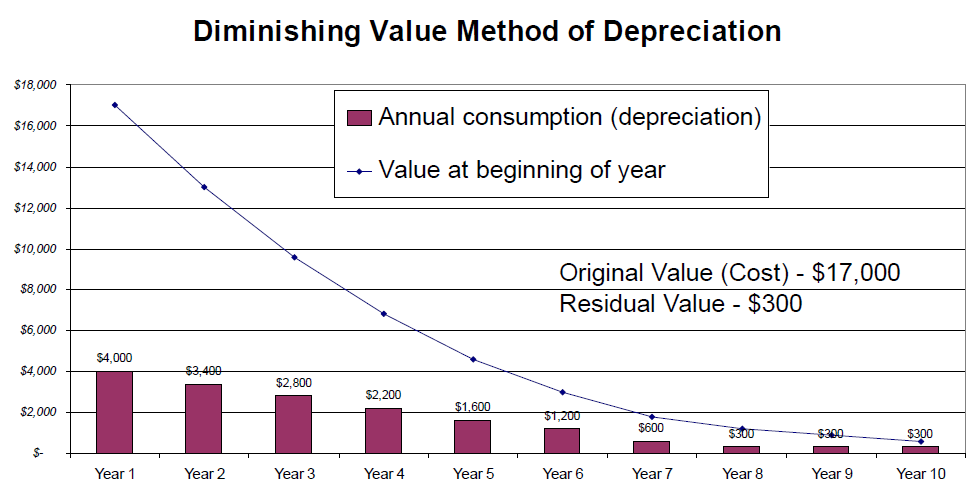

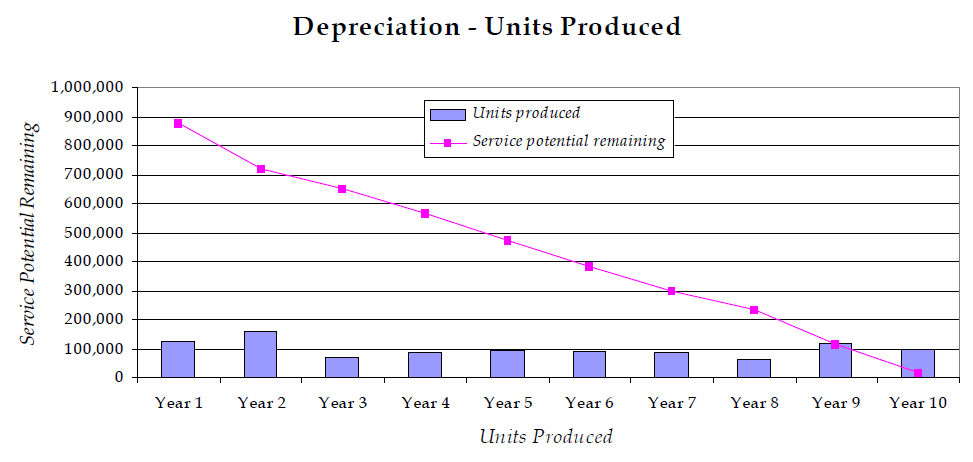

A variety of depreciation methods can be used to allocate the depreciable amount of an asset on a systematic basis over its useful life. These methods include the straight-line method, the diminishing balance method and the units of production method. Straight-line depreciation results in a constant charge over the useful life if the asset’s residual value does not change. The diminishing balance method results in a decreasing charge over the useful life. The units of production method results in a charge based on the expected use or output. The entity selects the method that most closely reflects the expected pattern of consumption of the future economic benefits embodied in the asset. That method is applied consistently from period to period unless there is a change in the expected pattern of consumption of those future economic benefits.

Related Pages

External Links